昨晚的聯準會利率決策會議全文,市場本來以為聯準會可能針對利率動向說些什麼,沒想到什麼也沒說,但隔壁的德股卻大跌。

我知道一堆英文沒人會看,我簡單翻譯一下,美國經濟成長在冬季明顯緩和了,就業成長和失業率跟上次會議內容差不多,因為能源價格下滑,消費市場人氣很旺,企業投資跟上次會議內容差不多,通貨膨脹率跟上次內容差不多,整體來說,就是跟上次會議結果差不多。

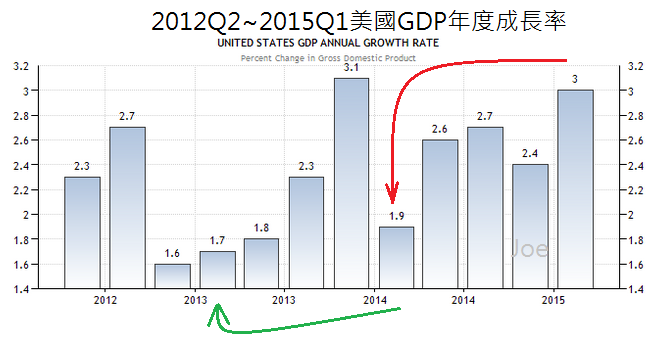

美國昨天公布第一季GDP又下修了,不過和2014年Q1相比,還是有明顯成長,今年第一季和去年情況會蠻類似的,第二季以後,數據會再度好轉,不用過於擔心。

Information received since the Federal Open Market Committee met in March suggests that economic growth slowed during the winter months, in part reflecting transitory factors. The pace of job gains moderated, and the unemployment rate remained steady. A range of labor market indicators suggests that underutilization of labor resources was little changed. Growth in household spending declined; households’ real incomes rose strongly, partly reflecting earlier declines in energy prices, and consumer sentiment remains high. Business fixed investment softened, the recovery in the housing sector remained slow, and exports declined. Inflation continued to run below the Committee’s longer-run objective, partly reflecting earlier declines in energy prices and decreasing prices of non-energy imports. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Although growth in output and employment slowed during the first quarter, the Committee continues to expect that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

http://www.federalreserve.gov/newsevents/press/monetary/20150429a.htm

1.整體看來fed有點在硬撐,美國經濟其實沒這麼好,

2.今天非美漲勢趨緩了.

3.台幣漲的太誇張了

2015年第一季GDP不是0.2%嗎?

怎麼JOE的圖變3?

和去年Q4相比是0.2%,和去年Q1相比是3%,基期不同造成帳面數據不同

請問JOE如果造年成長來看3%,後面美季年成長也都3%再回推每季成長大約會是多少呢?

以年成長來看算很恐怖的成長吧?

以美國這樣的大型經濟體來說,3%成長算是很強勁了

Joe您好!感謝您的分享~

這波生技的修正及逢國際天災對於醫藥的需求,您可以對於生技股IBB做分享嗎?

短空長多

JOE這次喊加碼的時間點非常完美.只可惜我已經吃飽了.只等升息.

上周我賣得差不多了,未來幾天留給像我一樣沒吃飽的人吃

Joe,你还会加码吗?

why not,昨晚我就加碼了

應該是買低賣高

不是加碼

邏輯上來說就是區間操作,低買高賣,高放空低做多

像我手腳慢的人只好按兵不動.有低價再買.大多時間都在看戲.挺無聊的.

台股投資人有萬點恐懼症

美股投資人有1萬8千點恐懼症XD?

台股萬點是好幾年的瓶頸了,道瓊指數18000也不過就是最近半年內才發生,不要對美股這麼嚴格拉

Joe大先前不是打算以六月為底線先獲利了結

多抱現金準備升息預期發酵後以便加碼

現在認為半年內宜區間操作

是因為現在預期的升息時間點比當初預期的更延後了嗎?

或是半年內可能是區間震盪取代修正的格局呢?

我上周有了解獲利阿,但距離升息我估計還有一季,如果短線跌得夠深,加碼一點無妨,升息前我還是會想辦法賣掉

Joe

看樣子美國升息6月是不太可能了,有可能是9月了,是原因這個原因,美國股市還不至於會有大於千點的修正,要延到6月才有可能發生嗎?

6月不會升息

請教joe,

歐洲的負利率

特別是依些國家發行負利率債券

一般債券是,我買債券,經過時間,拿回本金+賺利息

我不懂,為何歐洲一些國家發行10年期的負利率債券,可以有人買單??!!

買這種債券,時間到,還要付利息給發行人

這是虧錢的,十年下來,虧很大

那些國家,發行是為了趕熱錢

但是,買這債券的人,是在想甚麼??

另外,最近的消息

http://www.msn.com/zh-tw/money/topstories/%e5%b7%b4%e8%8f%b2%e7%89%b9%e9%80%99%e9%a0%85%e5%9b%a0%e7%b4%a0-%e5%8f%af%e8%83%bd%e8%ae%93fed%e5%8d%87%e6%81%af%e5%bb%b6%e5%be%8c/ar-BBj273y?ocid=iehp

巴菲特認為

歐洲的負利率,讓Fed非常難以升息

這是為什麼??

升息是收回游資的概念

是游資跑到歐洲,因此不需要升息

還是其他因素

但是,買這債券的人,是在想甚麼??

當然是期待有更傻更恐慌的人出更高的價來買下阿

就像台灣的房地產一樣

有些人就是覺得他可以靠負利率債券賺到利潤,心態不同很正常

我也認為歐洲債券不是很理想的金融商品,或許有人賭短線歐元會跌深反彈,從匯差上套匯,這種人另當別論,歐系貨幣兌美元跌深反彈就是現在進行式,反正歐元區不會倒,也不能說不可行